Listening to innovators, checking with the crowd: On the value (and limits) of validating foresight

TREND CONFIRMATIONS

In this piece, Luca Morena, CEO and Co-Founder of Nextatlas, shares what happens when early signals are put to the test. By comparing trend insights surfaced by the platform's proprietary methodology with subsequent Google search behavior, the article reveals a consistent pattern: early detection works. Nextatlas' distinctive integration of high-quality social signal curation and advanced AI modeling sets a new standard for evidence-based, scalable foresight.

At Nextatlas, we spend our days exploring “what’s next. ”But how can we be sure we’re truly ahead of the curve? In a field long shaped by intuition and expert sensing — valuable, but rarely verified — we felt it was time to put our approach to the test.

So, we rolled up our sleeves and took a pioneering step toward empirical validation: comparing our trend discovery dates with subsequent Google Trends search data. This exercise is a first-of-its-kind attempt in our space to validate our predictions against an external benchmark of public interest. It’s certainly not a perfect science (after all, not every trend can be neatly summed up in a Google keyword), but when there’s alignment, the lead time is often striking.

It’s an experiment, not a conclusion. But for us, it’s an encouraging move toward a more transparent, trustable model of trend forecasting.

Combining Early Signals with Mainstream Data

Our approach to trends has always been unique. We don’t rely on crystal balls or guesswork – we listen to early adopters. Every day, our platform scans the conversations of innovators and niche communities across social media, blogs, and other forums to spot the first flickers of emerging themes. By tracking statistically significant shifts in discussion, we’re able to detect when an idea is reaching an inflection point – the moment it starts accelerating in those forward-thinking circles. In other words, we catch trends just before they hit the mainstream.

What’s new is how we’re validating these early signals. For the first time, we systematically cross-referenced our "discovery dates" with Google’s search interest data. If we identified a concept in, say, mid-2021, we looked at Google Trends to see when public search interest for that term really took off. The assumption is simple: if our early adopter intelligence is truly ahead of the curve, there should be a noticeable spike in wider public interest after we sounded the alert. And that’s exactly what we found.

In case after case, the topics we flagged early only surged in Google searches months or even years later. It’s a strong signal that our model isn’t just finding random blips – it’s catching real trends that later resonate broadly. In fact, across hundreds of confirmed cases, we observed an average lead time of 3 years and 7 months between our early detection and a clear, sustained growth in public interest — measured at a fixed comparison point of March 2025. While we’re not focused on predicting when a trend will peak, our forecasting model often mirrors the actual trajectory of search interest remarkably well—including seasonal patterns and long-term dynamics. And in every validated case, that growth was already visible by the comparison date.

More recent trends naturally show shorter lead times, but the overall consistency across categories — from health and food to technology, sustainability, and culture — reinforces the reliability of our early detections. Empirical confirmation like this is still rare in our field, and for us, it marks a meaningful step toward building a more transparent and trustable model of trend forecasting.

Trends Confirmed Across Industries

One aspect we’re particularly proud of is thesheer breadth of trends that have been validated. The beauty of listening to innovators across domains is that our predictions aren’t confined to a single niche –we’re capturing the pulse of culture at large. The Google Trends comparison reinforced that strength. We saw our early signals later confirmed in areas ranging from food and wellness to technology, beauty, finance, and beyond. It’s one thing to anticipate a fad in one field; it’s another to consistently be early across culinary trends, health movements, lifestyle shifts, and even complex societal issues.

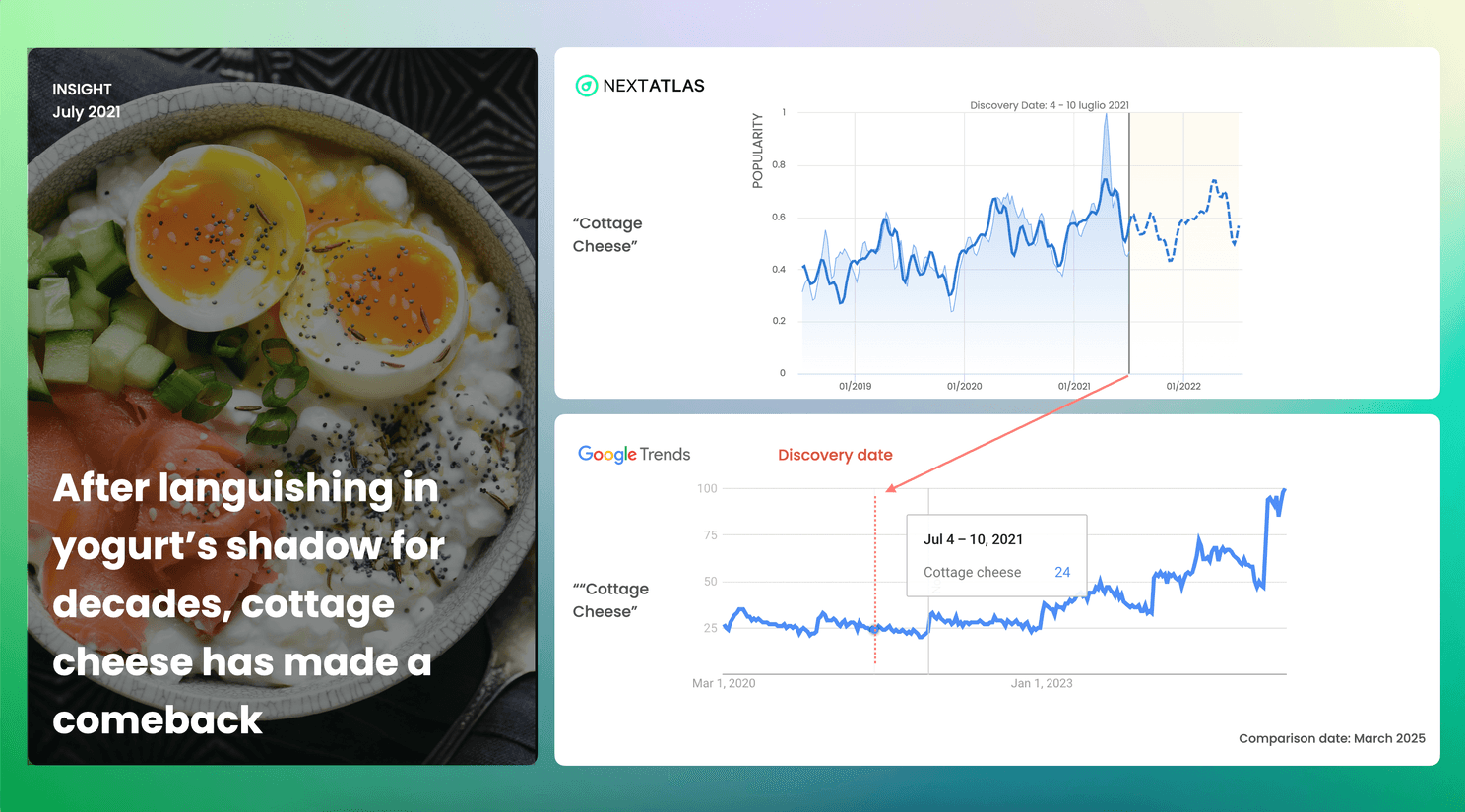

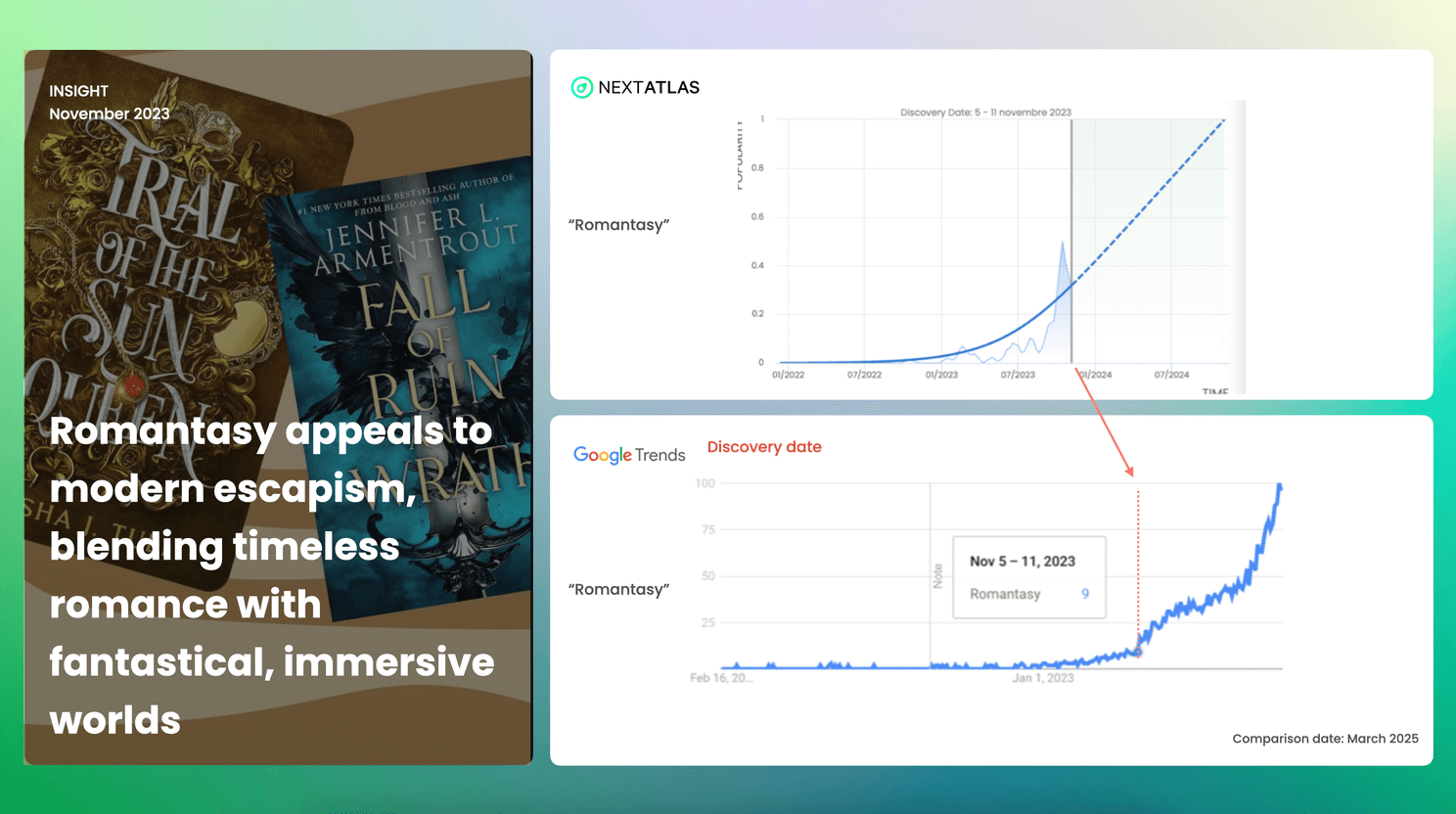

For example, consider “cottage cheese”. Yes, the unassuming dairy staple your grandparents ate. We spotted a renewed buzz around cottage cheese as far back as July 2021, noting that this once-“languishing” food was poised for a comeback . Sure enough, by 2023 and into 2024, cottage cheese was everywhere – from high-protein recipe videos to a spike in Google searches as people rediscovered it as a health food. Now it’s heralded as a trendy ingredient, confirming our early hunch. Or take “romantasy,” the whimsical blend of romance and fantasy in literature and media. We heard whispers of romantasy in late 2023 within online reader communities, recognizing it as an escapist outlet for modern audiences. Fast forward a year, and romantasy novels and shows are hitting the mainstream, with the term entering pop culture vocabulary – just as our initial insight anticipated.

We spotted renewed interest in cottage cheese back in July 2021—well before its mainstream comeback showed up in search trends

We detected rising interest in ‘romantasy’ in late 2023—shortly before the term took off in search trends, confirming its growing cultural traction.

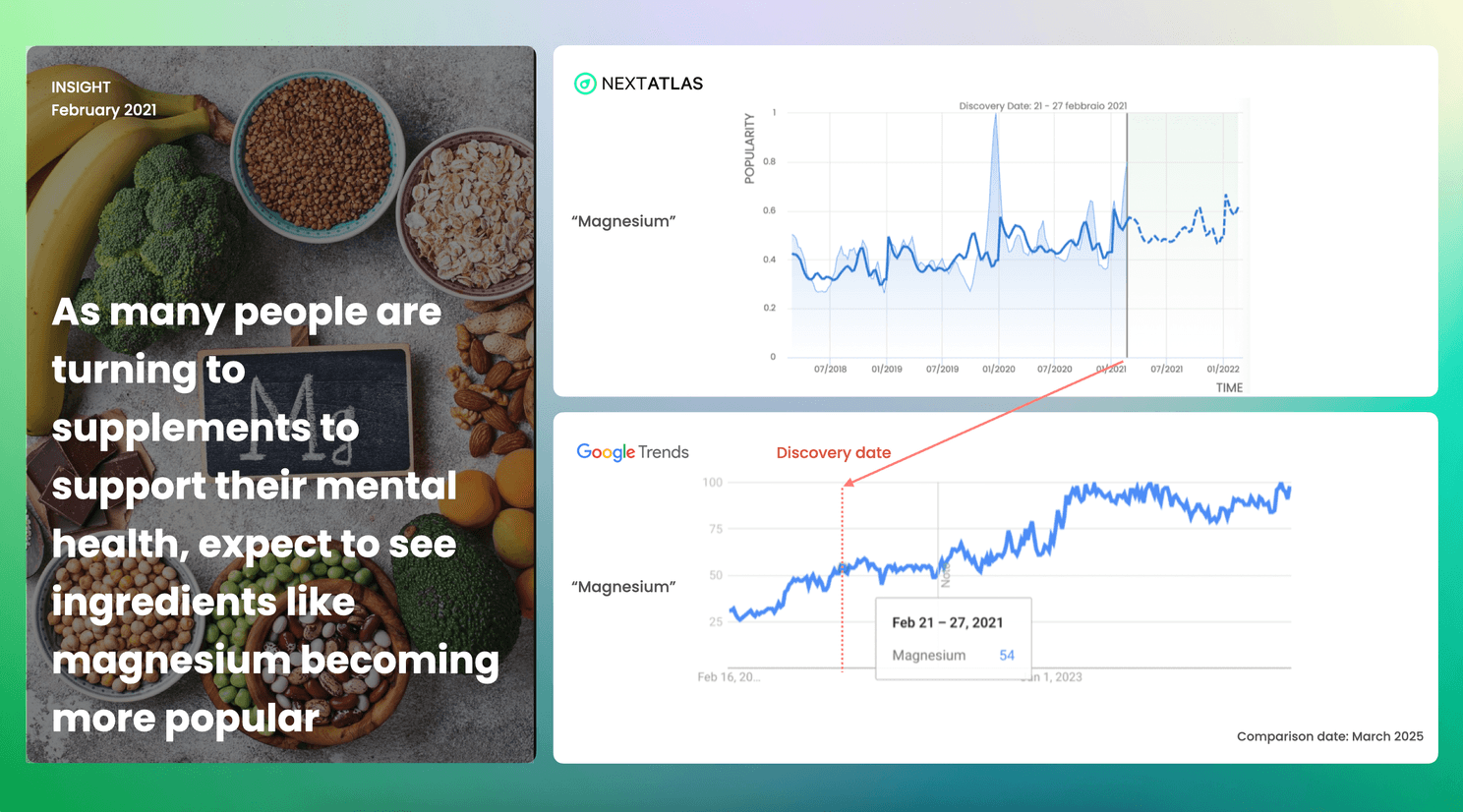

Health and wellness trends showed a similar pattern. In early 2021, our data picked up an uptick in conversations about magnesium supplements, tied to stress relief and better sleep. At the time, magnesium was hardly a headline wellness topic. But as anxiety and burnout grew, magnesium supplements gained huge popularity a couple of years later – evident in search trends and supplement sales alike. Another case: in late 2022 we noted growing concern about “metabolic health” among Gen X individuals – essentially, people talking about blood sugar, metabolism, and long-term wellness . Now, metabolic health is a hot topic in health blogs and weight loss programs, reflecting a wider public interest that arrived after our initial signal.

Magnesium emerged in our data in early 2021—Google searches started rising soon after, confirming growing public interest

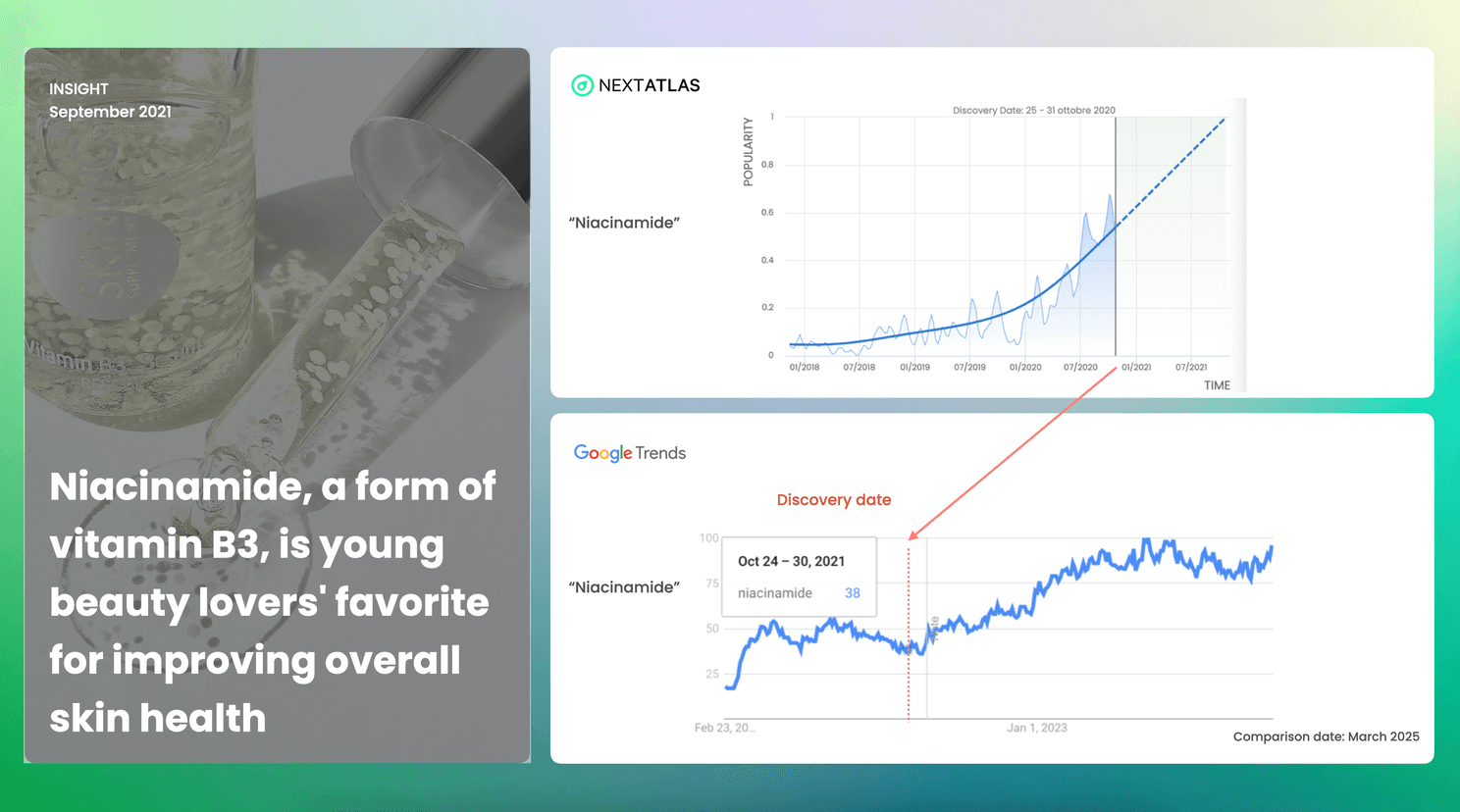

Niacinamide emerged as a rising skincare ingredient in our data by late 2021—well before it peaked in mainstream search interest

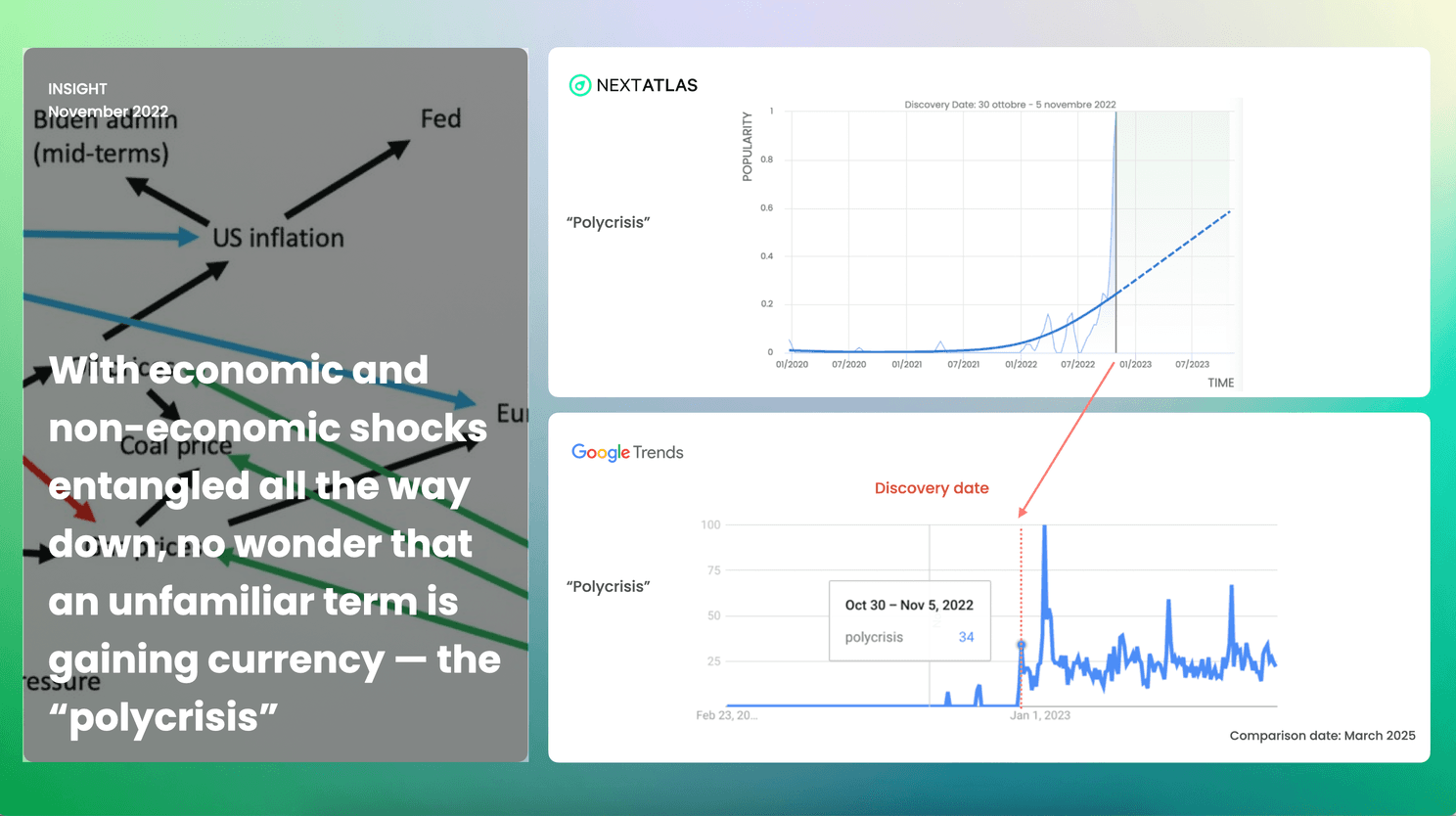

Even more abstract or complex phenomena have proven our early-detection model. Back in summer 2021 we flagged the rising tide of eco-anxiety – the worry and emotional distress about climate change’s effects. It wasn’t a mainstream term then, but today “eco-anxiety” has entered common usage as climate news intensifies, and people search for ways to cope with these fears. Similarly, the once-obscure notion of a “polycrisis” – essentially a tangle of overlapping global crises – caught our attention towards the end of 2022. That concept has since been echoed by world leaders and economists and is increasingly picked up in media and searches as a shorthand for our turbulent times. From fun food crazes to serious societal challenges, these examples illustrate a consistent theme: our early adopter intelligence often translates into mainstream reality.

The diversity of confirmed trends – whether it’s a snack making a comeback, a new literary genre, a dietary supplement, or a cultural anxiety – is exactly what we hoped to see. It tells us that our methodology isn’t limited to one type of trend; it’s capturing a fundamental dynamic of how ideas grow and spread.

Polycrisis’ appeared in our data in late 2022—just as it began gaining visibility in public searches, reflecting a growing need to name overlapping global challenges

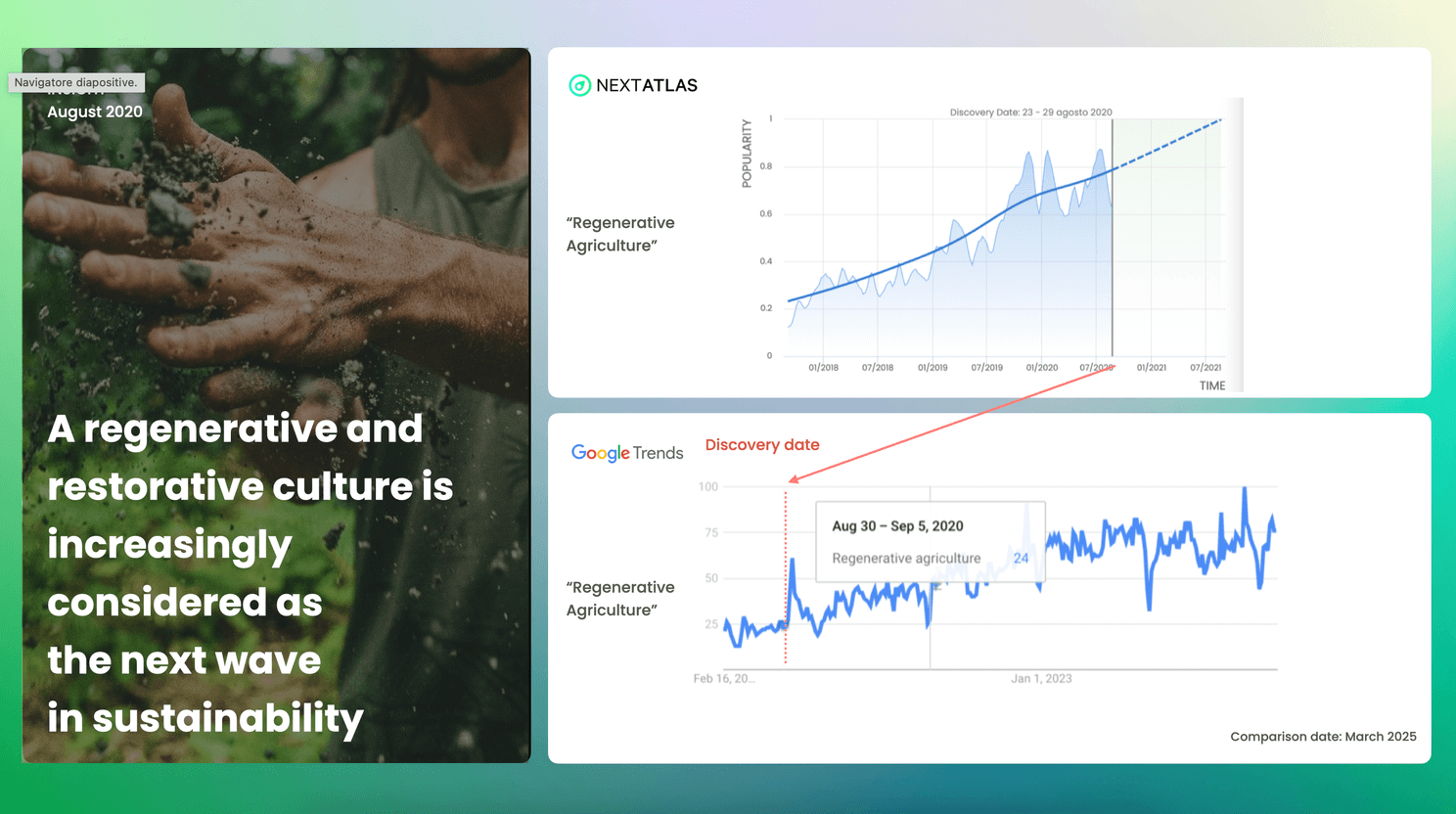

We identified momentum around regenerative agriculture in mid-2020—well ahead of the sustained public interest seen in search trends over the following years

Cutting Through the Noise with Curated Insights

In an age where every other platform seems to boast “AI-driven insights,” we know it’s important to clarify what makes Nextatlas different. Frankly, the internet is noisy – not every viral post or AI-generated buzzword represents a meaningful trend. From day one, we’ve taken a curated, quality-over-quantity approach. Our system focuses on trusted trendsetters and communities (over 300,000 industry-specific innovators, by our latest count) rather than scraping every hashtag du jour. This curated data foundation means that when our AI looks for patterns, it’s finding signals in a calmer, clearer pool. We combine machine learning with methodological rigor – tracking statistical upticks, validating significance – so that we’re confident an observed pattern is more than a coincidence.

The Google Trends validation exercise has been a powerful affirmation that this depth pays off. The trends we surface are not just early – they’re real. They have substance, enduring interest, and relevance beyond a flash-in-the-pan meme. That’s a crucial distinction. It’s easy to get swept up by the latest AI hype, making grand claims about “predicting the future.” We prefer a more grounded path: carefully detecting early signals, cross-checking them with external data, and ensuring we provide insights with genuine predictive value, not just pretty charts.

By being transparent about our process and even putting our predictions to the test against external benchmarks, we hope to cut through the noise. Our goal isn’t to brag about being right; it’s to make trend forecasting more credible and useful. Each time a trend we identified in its infancy shows up later as a verified mainstream shift, it strengthens our confidence and, we hope, earns the trust of our community and clients. It shows that our curated approach and clear signal detection can deliver foresight that you can actually act on, without the guesswork.

Toward a More Collaborative Forecasting Future

This validation project is just a first step, and we’re the first to admit there’s plenty more to refine. Many of the signals we identify aren’t standalone keywords, but richer constructs — combinations of concepts, audience and industry filters that reflect how culture actually moves. These insights often don’t translate directly into search data, which tends to capture a different kind of language — simpler, more utility-driven, and often removed from the expressive and context-rich vocabulary used on social media. Concepts like “feeling overwhelmed” or “trust in healthcare” aren’t always captured through a typical search term. Some cultural shifts are nuanced or slow-burning, and their impact might be better measured through qualitative observation or different data sources. We also know that when something trends in search is just one facet of understanding its trajectory. In short, there’s no single metric for “proving” a trend prediction, and we’re wary of anyone who claims to have a crystal ball. What we do believe in is making trend intelligence more transparent, collaborative, and grounded in evidence.

While we were working on this validation project, Matt Klein published The Uncomfortable Truth: Data Lies — a timely and thoughtful critique of how data can be misused in the insight industry. He’s right to remind us that “data can tell any story you want it to tell,” and that overreliance on numbers can distort rather than clarify. Our work isn’t a counterpoint to that view, but it does sit adjacent to it: an attempt to use data carefully — not to prove a point, but to explore where early signals and broader public patterns genuinely align.

By sharing our findings openly, we hope to encourage a more rigorous dialogue in the trend forecasting field. Imagine a future where trend forecasts come with footnotes and comparison – where clients can see why a prediction is credible and how much lead time they might have. That’s the kind of ecosystem we want to help build.

We know there’s no perfect way to prove a trend. But we also know the value of trying — openly, humbly, and with an eye on improving the practice. By validating what we can, and acknowledging what we can’t, we hope to make foresight a little more credible for everyone who depends on it.

by Luca Morena, Nextatlas CEO and Co-Founder

Credit: Flo Magazine's interview with Luca

Trend lines, data, and information described in this article emerge from the ongoing analysis performed by Nextatlas on its global observation pool made of innovators, early adopters, industry insiders expressing their views on Twitter, Instagram, and Reddit.

To learn more about our AI, discover Nextatlas Methodology here

Related articles:

Italy

Torino - Via Stampatori 4, 10122(Operational headquarter)+39 011/0864065VAT number and registration number at the Registro delle Imprese di Cagliari: 03428550929 paid share capital € 167.740,00 — © 2024 iCoolhunt SpA.