What’s Driving the Future of Mobility?

TRAVEL & TRANSPORTATION

In an unprecedented period of stillness, consumers are exploring and elevating new paradigms of mobility that will shape the industry for years to come

What happens when we start moving again? For most of us, the prospect of uninhibited movement couldn’t be any more exciting, but it’s also currently plagued (…sorry) by a lot of uncertainty about the future of mobility.

Over the last few months, we published a trio of reports detailing evolving trends, behaviors, and ideas within the mobility sector in three incrementally widening spheres: from the Urban Level to the Regional to the Global.

In each of these spaces, we found individual experiences, perspectives, and priorities that, together, paint a portrait of an industry on the precipice of real, lasting change. In this unique moment of quiet, people were able to take a step back from the rapid pace of mobility’s innovations. From afar, they looked beyond simply getting from point A to B and reframed mobility in the context of a new set of activities, concerns, and philosophies from the last year.

Human scale cities

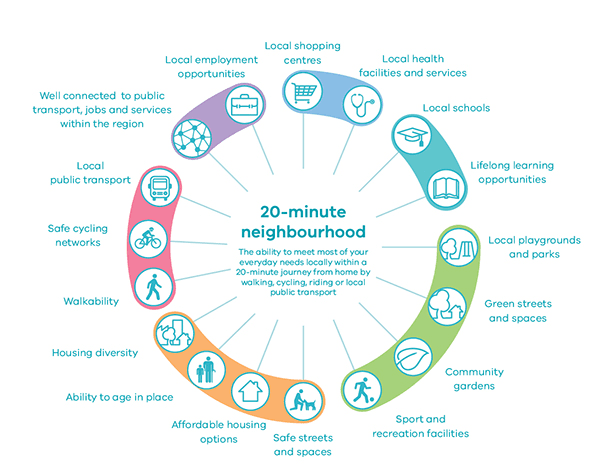

On the city scale, we found that this reached all the way to rethinking entire aspects of urban planning. After spending months at home and in their immediate neighborhood, people got used to a seriously smaller daily footprint. As they became more comfortable and receptive to this way of life, localized urban models held water and thrived in new urban landscapes. Melbourne’s 20-minute neighborhood project (an extension of the 15-minute city model) not only persisted through the pandemic, but was actually accelerated due to its positive impact and reception from the community during and after the lockdowns.

Core tenets of Melbourne’s 20-minute Neighborhood system

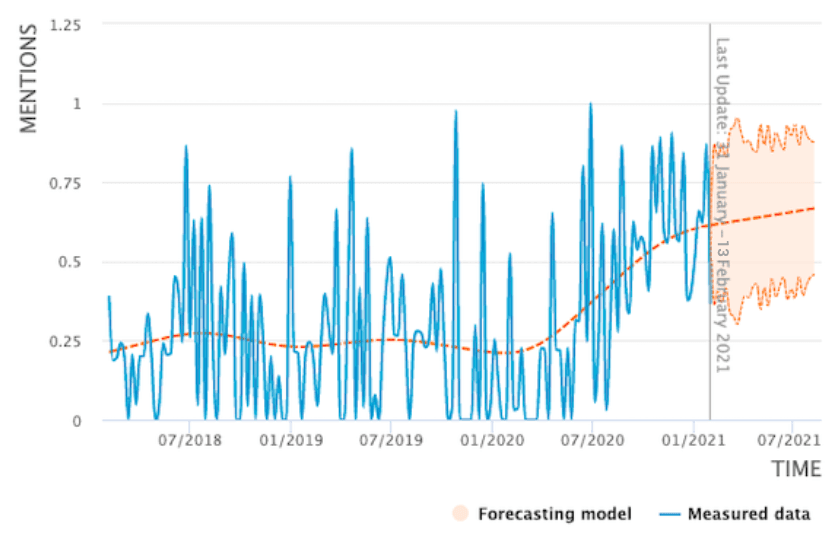

In tandem, micromobility and short distance transport have been elevated to new prominence. Bike sales skyrocketed this summer, echoed in the tremendous growth of the “cyclinglife” tag across social media. And there’s no signs of slowing down; according to our AI, the tag is predicted to grow +47% over the next six months.

Mentions of “cyclinglife” over the past years show a serious uptick in 2020

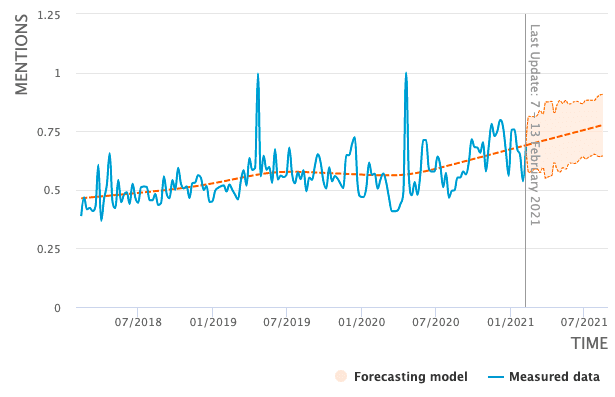

We also looked into what mobility might mean to a recovering travel industry. Stuck at home, once frequent travelers reflected on the impact of their travel patterns and considered more eco-friendly means of travel. Joined with a growing regenerative ecotourism movement, we saw sustained and projected growth in trends & insights about sustainable travel across all demographics on Nextatlas.

Our Green Pace trend, which covers the growing sentiment against air travel for its environmental impact, is projected to grow +13% over the next 6 months.

Growth of our Green Pace trend was noticeably accelerated over the last year

In turn, there’s optimism for ecoconscious slow travel to firmly plant its roots on the other side of the pandemic. So much so that UK-based travel company Byway launched last year in the midst of rampant travel restrictions. Committed to curated itineraries centered around low-impact travel methods and patient experiences in off-the-beaten path locations, Byway alludes to a new set of priorities in leisure travel.

Travel firm Byway highlights a growing slow travel ethos

Mobility’s modern evolution is nothing new

Even before the pandemic, the industry was developing in hyperdrive as discussions about electrified planes and autonomous cars swirled. Nevertheless, this current iteration stands apart in many ways. After months to objectively reflect on the mobility industry, consumers are now thinking not about the individual solutions, but about what kinds of larger systems they will empower.

So, while driverless cars will no doubt be an amazing achievement, meaningful innovation in mobility will need to exist in the context of something bigger. Scaled-down models of urban planning, slow travel philosophies, and countless other far-reaching paradigms are reorienting the industry’s north stars.

Brands inside and adjacent to the mobility sector have a special opportunity right now to align themselves with these emerging visions of systems beyond mobility; they’d do well to grab hold of the moment before it flies away.

Trend lines, data, and information described in this article emerge from the ongoing analysis performed by Nextatlas on its global observation pool made of innovators, early adopters, industry insiders expressing their views on Twitter, Instagram, and Reddit.

To learn more about our AI, discover Nextatlas Methodology here

Related articles:

TREND FORECASTING

How ChefAtlas Redefined Barilla's Foodservice Foresight at ESOMAR Trends Horizon 2025

Italy

Torino - Via Stampatori 4, 10122(Operational headquarter)+39 011/0864065VAT number and registration number at the Registro delle Imprese di Cagliari: 03428550929 paid share capital € 167.740,00 — © 2024 iCoolhunt SpA.